Almsgiving, or Zakat (also spelt Zakaat, Zakah), is one of the five pillars of Islam. It is a vital act of worship for Muslims alongside the other four sacred pillars: prayer (Salah), fasting (Sawm), pilgrimage (Hajj) and belief in Allah and His Messenger, Prophet Muhammad (ﷺ) (Shahadah).

“And establish prayer and give Zakat, and whatever good you put forward for yourselves – you will find it with Allah.”

Qur’an, 2:110

Every compulsory for every sane, adult Muslim who owns wealth over a certain amount (known as the Nisab) must pay 2.5% of it as Zakat. Or as it’s formally known, Zakat al Mal (or Zakat al Maal).

The Nisab is the minimum amount of wealth a Muslim must possess before they are required to pay Zakat. This amount is often referred to as the Nisab threshold.

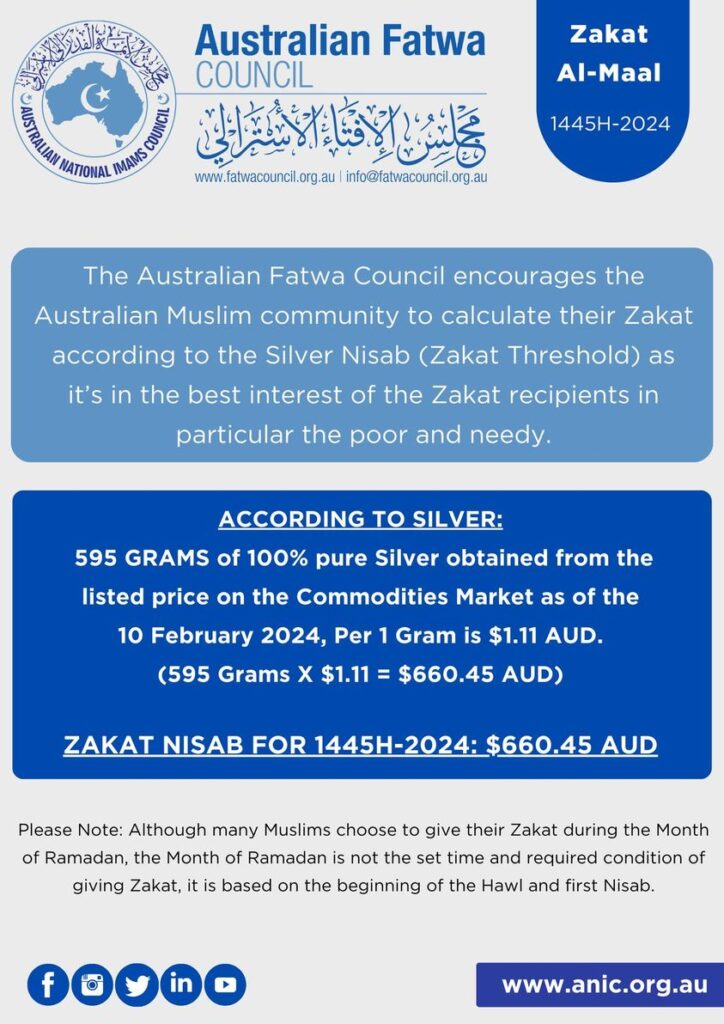

Gold and silver are the two values used to calculate the Nisab threshold. Most scholars will recommend that Muslims use the Nisab value for silver for Zakat as it is in the best interests of the Zakat recipients, particularly the poor and needy.

As the value of silver and gold fluctuates, the Nisab threshold often changes from year to year.

Currently, the value for silver in 2024 is $1.11 (AUD) per gram. If using the opinion of 609 grams of silver for Nisab, the Nisab threshold is approximately $675.99. For 595 grams of silver, it is $660.45 (AUD). This is the amount set by ANIC for 2024.

Your Zakat is an Amanah (trust), and we take that responsibility very seriously. At Islamic Relief, we follow a scholar-verified Zakat Policy to ensure your Zakat reaches the world’s poor and needy as soon as possible, in accordance with Islamic principles.

Your donations have powered some of our most crucial work, which has helped provide relief to millions of people living in war zones, poverty, disease and climate disasters.

Together, we’ve given essential aid to families in drought and famine-struck countries across East Africa. We’ve supported communities affected by earthquakes in Türkiye and Syria. And we continue to provide hope for our brothers and sisters in Gaza facing unimaginable suffering.

Your donations are helping transform the lives of generations of families, ensuring they have access to food, medical care, clean water, education and the tools to support themselves for years to come.

Trying to figure out how much you need to pay based on your Zakatable assets and liabilities? Discover the value of your Zakat by using our Zakat Calculator!

It is mandatory on any adult, sane Muslim with wealth above a certain amount (Nisab). Eligible Muslims pay Zakat once a year, and it is due as soon as one lunar (Islamic) year has passed since meeting or exceeding the Nisab. This obligatory donation is then distributed to those who meet the criteria to receive it.

The Nisab is the minimum amount of wealth a Muslim must possess before they are required to pay Zakat. This amount is often referred to as the Nisab threshold.

Gold and silver are the two values used to calculate the Nisab threshold. The Nisab was set by the Prophet Muhammad (ﷺ) at a rate equivalent to 87.48 grams of gold and 612.36 grams of silver (or 85 grams of gold and 595 grams of silver, according to another opinion).

However, as gold and silver are not commonly used nowadays, their equivalent value in local currencies often fluctuates. This can make the Nisab threshold different year on year.

It should be paid as soon as possible prior to or at the time that you’ve earned the requisite amount of Nisab each lunar year (hawl), or one year after you last paid it.

TIP: A good way to ensure you make the payment in a timely fashion is to pay it during a time it is easy to remember, such as every Ramadan or the first 10 days of Dhul Hijjah.

This obligatory donation should amount to 2.5% of your total Zakatable wealth. For example, if your total assets (after any debts owed) amounted to $10,000, you would pay $250.

There are eight categories of people who are eligible to receive Zakat. These include:

At Islamic Relief, we take the responsibility of delivering your donations very seriously. We know that we are accountable to you, to the people we serve, and, ultimately, to Allah.

We ensure your Zakat reaches the poor and needy. To relieve them from suffering and provide for their vital needs – for they have a right over us.

“Those in whose wealth there is a recognised right for the needy and the poor.”

[Qur’an 70:24-25]

Yes, you can give Zakat to a relative, but you cannot give it to your immediate family. This includes your spouse, children, and parents i.e. all the descendants and ascendants, if you subscribe to the Hanafi and Hanbali schools of jurisprudence. However, in the Shafi’i and Maliki schools, this may be allowed in some scenarios.

No, it is only obligatory on Muslims.

No, Zakat al-Mal is due when a person’s (if Muslim, adult and sane) wealth reaches the Nisab amount. It can also be paid anytime during the year.

Zakat al-Fitr, on the other hand, is paid by the head of the household for each member of the family (even children and babies), before the Eid al-Fitr prayer. Other names for it include Eid Fitrana and Sadaqatul Fitr.

For every year that you owe, take 2.5% from the total wealth you had at the end of that year and pay that in Zakat. If you are not sure how much wealth you had, estimate it to the best of your ability.

For example, say you have not paid Zakat since Ramadan 5 years ago. Therefore, you’ll need to work out how much wealth you owned every Ramadan for the last 5 years and pay 2.5% of that.

The general answer would be yes, however, we would strongly urge you to consult a scholar about this.

Zakat is not only a sacred pillar of Islam – it has the power to ease the suffering of millions around the world.

Picture this: if just the ten richest people in the world paid Zakat – that would be a staggering $14.9 trillion AUD! That amount of money in tackling poverty would be huge. That is the potential of Zakat.

The recipients, according to the Quran are as follows:

“Alms are for the poor and the needy, and those employed to administer (the funds); for those whose hearts have been (recently) reconciled (to truth); for those in bondage and in debt; and for the wayfarer: (Thus is it) ordained by Allah, and Allah is full of Knowledge and Wisdom.”